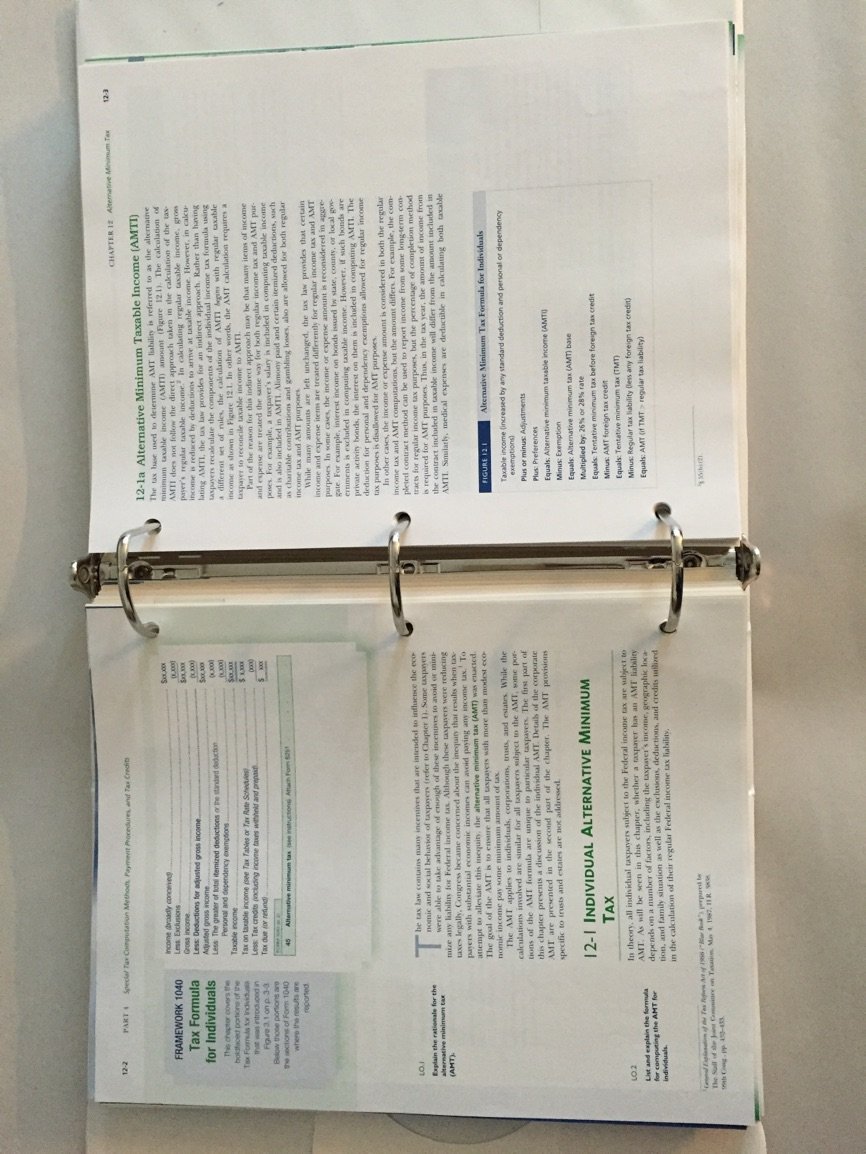

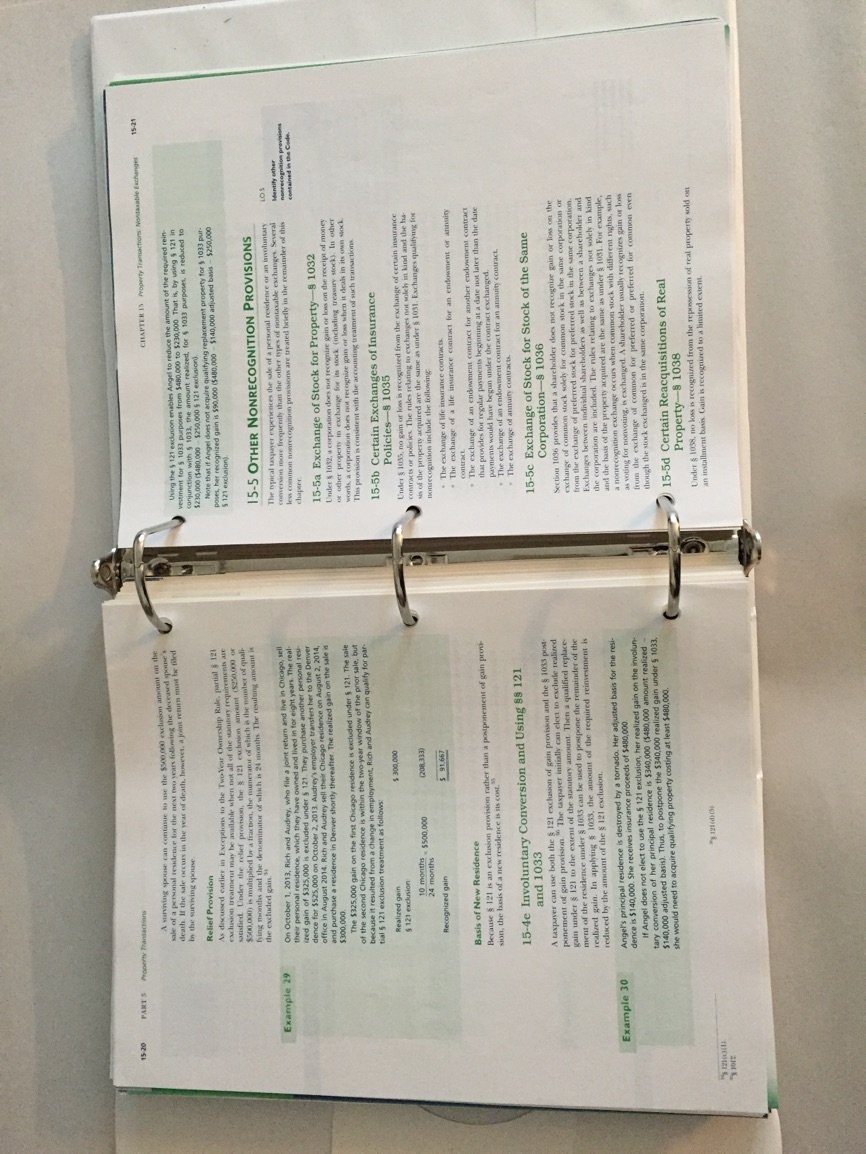

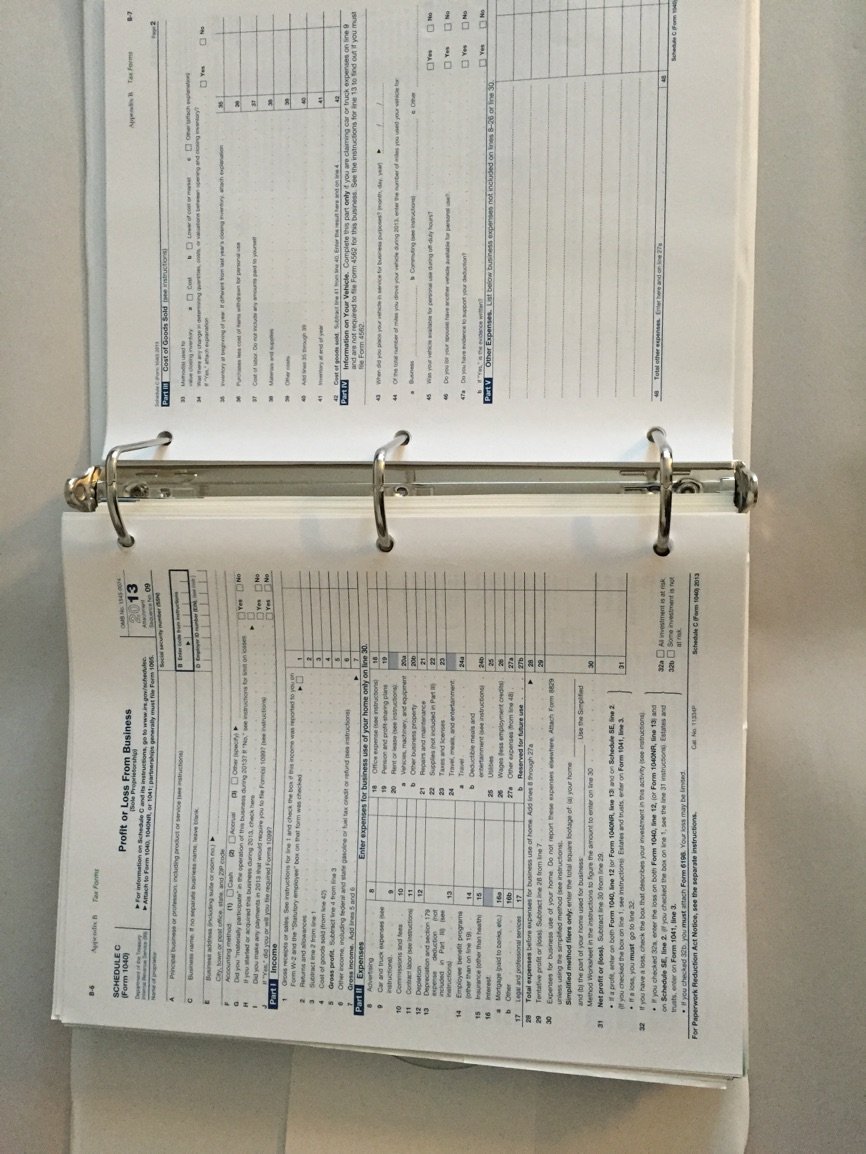

Introduce your students to individual income tax concepts and today’s ever-changing tax legislation with Hoffman/Smith’s SOUTH-WESTERN FEDERAL TAXATION 2015: INDIVIDUAL INCOME TAXES, 38E. Renowned for its understandable, time-tested presentation, this book remains the most effective solution for helping students thoroughly grasp individual taxation concepts. This book reflects the latest tax legislation for individual taxpayers at the time of publication, while continuous online updates keep your course current with additional tax law changes as they take effect. Proven learning features, such as “Big Picture” examples and tax scenarios, help clarify concepts and provide opportunities to sharpen students’ critical-thinking, writing skills, and online research skills. The chapter-opening feature “Framework 1040: Tax Formula for Individuals” shows how topics relate to the 1040 form.

South-Western Federal Taxation 2015: Individual Income Taxes (with H&R Block(tm) CD-ROM & RIA Checkpoint 1 term (6 months) Printed Access Card)

$53.07

This textbook teaches concepts of individual income tax and tax legislation for students studying accounting and business.

Additional information

| Weight | 2.286 lbs |

|---|---|

| Dimensions | 22.9 × 3.8 × 28.6 in |

Reviews

There are no reviews yet.