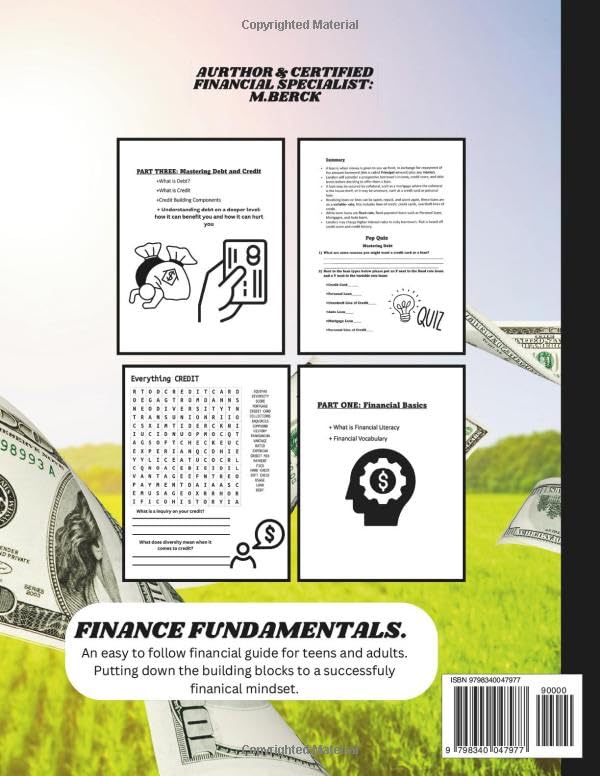

The Financial Fundamentals activity workbook is the go-to beginner’s guide to personal finance. Providing you with a solid foundation of money skills, knowledge, and experiences to help make wise financial decisions. Setting essential building blocks down for a successful future. I can’t tell you the how many times I’ve heard I wish this was taught in school. Our education systems have definitely fallen short when it comes to preparing us for the future. Many lessons we wished we learned earlier on and understood, to not only save more but invest in your future early on.How many times clients have made simple mistakes that had large impacts due to just not understanding what creditors or bankers are asking them. Finance, and Money shouldn’t be so complicated and long winded designed to confuse even the smartest of us. That’s why I decided to take my 15+ years of knowledge in banking, and what I’ve learned from becoming a Certified Financial Specialist and turning it into an easy to follow, engaging, and knowledgeable workbook for adults and teens alike. This activity workbook is full of all the things you and your teen need to know about MONEY. With this easy-to-follow activity workbook, you will learn how to choose first bank account and what types of pros and cons different types of institutions have for individual needs. Learning how to read and maintain a healthy credit score The trick is to develop the right money mindset so you can start controlling your money instead of letting your money control you. No matter your experience level or how much money you have in your bank account right now. This book is the solution young adults crave. It’s simple, actionable, and addresses the specific struggles of living and budgeting in the digital age. Read a bank statement Avoid financial fraud and fee’s Identify your spending personality (and keep it in check) Use credit responsibly Save for a rainy day Develop a healthy, long-term outlook to investing Financial vocabulary- understand what these bankers and financial gurus are talking about in simple term’s The Financial Fundamentals quick glance: Part 1: The Financial Basics: Vocabulary, and what is Financial Literacy Fun exercises and easy to follow vocab lessons to help you become acquainted and versed in financial literacy. Part 2: Deeper Dive into Banks & Accounts:Checking’s, Savings, avoiding fees, and preparing for the future. A savings mindset with goal setting exercises, and putting you in a prepared mindset. Encourage responsible habits by introducing the concept of short-term and long-term financial goals. Working around getting unexpected fees as well as learning how to communicate on how to prevent future fees. Check writing skills Part 3: Mastering Debt & Credit Lay the foundation for a strong understanding of credit. Simple explanations and relatable concept of borrowing and the importance of responsible credit use. Breaking down how your credit is scored, and the elements utilized by the credit bureaus. Smart ways to quickly build credit and prevent negative impact Part 4: Budgeting and Getting PAID: Break down the fundamentals of budgeting into easy-to-follow concepts. Interactive exercises help children grasp the importance of saving, spending, and making informed financial decisions. Needs vs. Wants: Teaching you essential skill in distinguishing needs and wants. Scenarios and activities assisting you in making thoughtful choices about their spending prioritiePart Five: Plan Part 5: Retirement Thinking of your Future Self How to save for retirement and what retirement means taxes and all!

The Financial Fundamentals Workbook | Financial Literacy for Adults and Teens Simplified: Easily Learn how to Manage Money , Save, to Build credit and … teen: Activity Workbook: Money Made Simple

$14.99

This workbook teaches students essential financial literacy skills, including budgeting, saving, and understanding credit.

Reviews

There are no reviews yet.