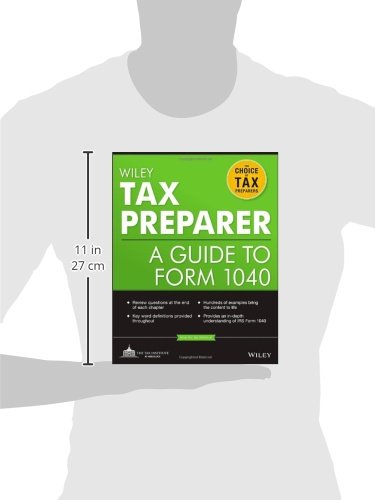

Whether you’re already a tax preparer or you’re looking to become one, you need a firm grasp of the tax concepts on which individual taxation is based. We created the Wiley Tax Preparer as a refresher for the experienced tax preparer, and as a readable guide for the less-experienced tax preparer.

This timely guide is an essential tax resource providing you with useful information on tax principles and filing requirements that a preparer must know to complete a 1040 series return and associated schedules. You’ll refer to it time and again, for information about:

Practices and Procedures

- Penalties to be assessed by the IRS against a preparer for disregard of the rules and regulations

- Furnishing a copy of a return to a taxpayer

- Safeguarding taxpayer information

Treatment of Income and Assets

- Taxability of wages, salaries, tips, and other earnings

- Reporting requirements of Social Security benefits

- Determination of basis of assets

Deductions and Credits

- Medical and dental expenses

- Types of interest and tax payments

- Child and dependent care credit

Other Taxes

- Alternative Minimum Tax

- Self-Employment Tax

Preliminary Work and Collection of Taxpayer Data

- Collecting a taxpayer’s filing information and determining their status

- Determine filing requirements, including extensions and amended returns

- Personal exemptions and dependents

Completion of the Filing Process

- Check return for completeness and accuracy

- Tax withholding, payment and refund options, and estimated tax payments

- Explaining and reviewing the tax return

Ethics and Circular 230

- Preparer’s due diligence for accuracy of representations made to clients and the IRS

- Sanctions that may be imposed under Circular 230

- Rul

Reviews

There are no reviews yet.